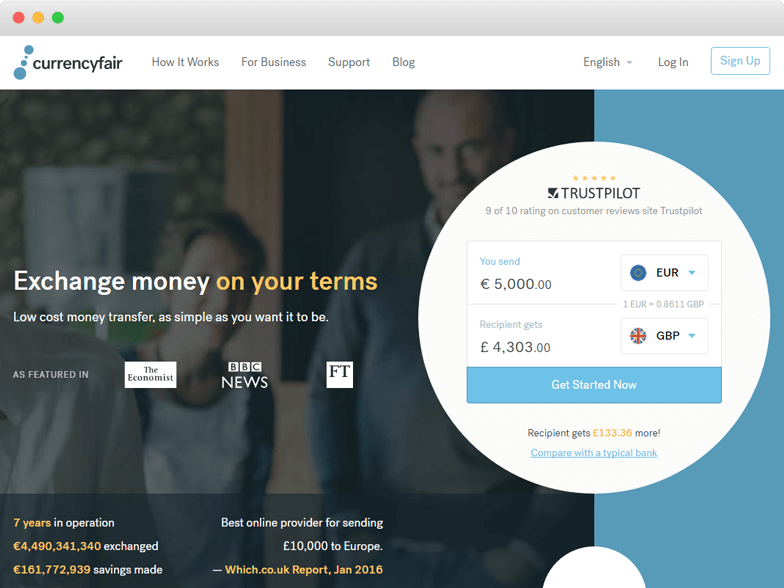

CuurencyFair Review: Fast and Secure Money Transfer 2024

CurrencyFair Review by Exchange Rate IQ

Is CurrencyFair reliable to send money abroad? This is the first question hits our mind when we were trying the company to provide best CurrencyFair review to our users. And indeed it is which provides the best services to its customers with 24*7 customer assistance. The company has a competitive exchange rate which is providing services in over 150 countries.

CurrencyFair is an online peer-to-peer currency exchange and money remittance company with headquarter in Dublin, Ireland. It offers money transfer services to individuals and businesses in 18 currencies. At CurrencyFair, customers can match with another customer by using Auto-Transaction or can set the desired rate and exchange with the one who is going to opposite currency direction. It offers free multi-currency CurrencyFair wallet which has bank level security for your currency and keeps money always ready for exchange. Benefits of using CurrencyFair are:

- Best Exchange Rate or you Can Choose Your Own Rate.

- Low Transfer Fees.

- Can Transfer Money for Multiple Purposes.

- Choice of Payment Options.

Review of CurrencyFair :

CurrencyFair is an Ireland based fintech startup with offices in Australia and the UK. Recently it has been named as one of Irish Tech News’ Top 20 Companies. It was launched in the year 2009, and in the past 9 years, over 8 billion Euros are exchanged by the customers using its services.

CurrencyFair fee charge is approximately $4 or €3 for its money transferring services. It offers remittance services from the USA, Europe, Canada, Australia and New Zealand to 50+ countries. It has only one payout option, and that is the bank account. You can transfer the funds from it by associating the bank account, no matters if it is personal or business transfer. It does not have any maximum limit to transfer funds, and you can send the amount as much as you want to but have a minimum limit of $8.

It has provided a support form, where customers can post their queries, and the support staff will connect with them within 24 hours. It does not provide any contact details so customers cannot connect them directly.

It employs world-class security, so customers can stay worry free with their personal data.

Overall, we rate CurrencyFair 9 out of 10.

Pricing : How much does CurrencyFair cost?

CurrencyFair Transfer Fees

The rates offered by CurrencyFair are highly competitive. You can choose the rate offered by it or can set your own rates and wait to be matched with other customers exchanging the opposite currency.

CurrencyFair has a fix transfer fee of €3 and on an average one needs to pay approximately 0.4% of amount exchanged. It charges 0.25% to 0.3% (depending on the currency exchanged) of the total amount when customers match each other. In case, when there is no customer matched, it makes a match for you by itself and charges approximately 0.4% to 0.6% of the amount, depending on the currency exchanged. So, overall one needs to pay in between 0.1% to 0.6% of the total amount with a fixed transfer fee. Although CurrencyFair regular transfer fees are the currency equivalent of €3, that if a new customer signs up they get 3 free transfers. You can also calculate the rates with CurrencyFair calculator which shows the live rates one will get for making the immediate transfer.

CurrencyFair Personal and Business Transfers

It offers personal and business transfer, whose details are provided under:

| Description | Personal Transfer | Business Transfer |

|---|---|---|

| Minimum Amount of Transfer | $8 | $8 |

| Transfer Methods | Online | Online, Bank account to Bank account |

| Transfer Speed | 1-2 days | 3-5 days |

| Transfer Fees | EUR 3 | EUR 3 |

These transfer services of CurrencyFair are not available in the US. So the residents here cannot use its facilities for making the online transfer.

CurrencyFair Exchange Rates

CurrencyFair offers competitive exchange rates where you can select a better exchange rate according to your choice and charges 0.25% or 0.3% (depending on the currency pair being exchanged) of the total amount exchanged on each side when customers match each other.

Transparency: Does CurrencyFair have any hidden fees?

CurrencyFair Hidden Fees

There is no hidden fee when you use the services of CurrencyFair money transfer. Once you choose the currency and country, it will provide you with the details of approximate fees. The further fee will get updated as you enter the amount and other details. The total amount you need to pay will be shown on the transaction page and not a single penny more.

CurrencyFair Transfer Tracking Details

When it comes to transparency, CurrencyFair peer to peer transfer has not provided ant tracking transaction page. One needs to ask with the support team on their query page regarding the same. But you should note that CurrencyFair provides email services for transaction tracking.

Transfer Speed: How long does it take to send money through CurrencyFair?

CurrencyFair money transfer has a variable transaction speed depending on the currency and country. You can also check the CurrencyFair Process Time here. The company tries to send the money as fast as possible but it sometimes also depends on the banks through which the customer is sending funds. If customers need to send money quickest, they should transact in the morning, as most of the banks have a cut-off time in the afternoon. So the transfers done after the cut-off time will take place on the following day.

Before commencing transfer, one should note that personal transfer takes approximately 1-2 days while business transfers take more time with up to 3-5 working days. There is a single pay-in option available in the company, and that is the bank account. Click here for CurrencyFair login and start your transactions now.

Coverage: How many Countries & Currencies does CurrencyFair support?

With CurrencyFair, one can send money from Australia, Europe, Canada and New Zealand to more than 50 countries in the 19 currencies. Following are the currencies in which CurrencyFair supports transactions:

Currencies Supported by CurrencyFair

| Australian Dollar | Canadian Dollar | New Zealand Dollar |

| Polish Zloty | Czech Koruna | South African Rand |

| Danish Krone | Swedish Krona | Euro |

| Swiss Franc | Great Britain Pound | UAE Dirham |

| Hungarian Forint | US Dollars | Norwegian Krone |

Recently, it has launched its transfer services in Singaporean Dollar (SGD), so, customers can send money from Singapore also now with CurrencyFair. The recipients can receive money from Singapore to Australia, United Arab Emirates, South Africa, Hong Kong, UK, USA, Canada, etc.

Countries having CurrencyFair Facilities

Some of the major countries where you can transfer money through CurrencyFair in the above-listed currencies are provided in the table below:

| United Kingdom | United States | UAE | Thailand | Switzerland |

| Qatar | Spain | Sri Lanka | South Africa | India |

| China | Canada | Brazil | Costa Rica | Bhutan |

| Australia | Ireland | Sweden | Saudi Arabia | Oman and more |

CurrencyFair also allows currency transfer for the following purposes:

- Inexpensive transfer for international students.

- Property owners who want to paid loans.

- Overseas workers who want to send money regularly to the family.

- Non-emergency transfers, which can take up to 7 working days.

- Business transfers, paying overseas salaries, receiving payments, etc.

Besides all these transfer services, there are many areas in which CurrencyFair can grow. It has recently started providing its services from the US and one can send USD to 50+ countries. This will help it to become one of the major player in the money remittance industry.

CurrencyFair Promo Codes & Offers

CurrencyFair Transfer Process

How does CurrencyFair Work?

Go to the website of CurrencyFair and click on “Get Started Now” in the mid of home page.

Select the type of account, either Personal or Business.

If you have a personal account, you can also signup with your Facebook account. If you have a business account, enter the email and create a password.

Provide all your personal and contact details.

You need to prove your identity by submitting any of your legal documents.

Enter the bank details.

Enter the bank and personal details of the recipient.

Enter the amount you want to send through CurrencyFair.

Double-check the details of the recipient and send the money.

It will provide you with a reference number through which you can track your transaction.

User experience of CurrencyFair

CurrencyFair is a highly responsive website. Once you enter the amount that you want to send at CurrencyFair Rate convert, you will get the details of currency in which you want to convert without a click. User sign up is also very easy, and one can also make an account through Facebook login. All you need to do is to select if the transfer is for personal purpose or business purpose. It also offers Android App and iOS App to its users, which will help them to transfer money from wherever they are. You can compare the CurrencyFair rates and bank rates for money transfer without login or sign up into the app. This helps the customers to know which company is offering them the best rates and they need not make an account on every website. You can download CurrencyFair app here:

When it comes to customer satisfaction, then CurrencyFair limits to online assistance only, where you need to fill their contact form.

They have 24/7 assistance as they have an office in Australia that handles queries when their Dublin office is closed.

CurrencyFair contact number:

Dublin: +353 (0) 1 526 8411 (11 pm Sun - 6 pm Fri IST)

Australia: +61 (0) 282 798 642 (8 am Mon - 3 am Sat EST)

UK: +44 (0) 203 3089353 (11 pm Sun - 6 pm Fri GMT)

When we talk about the payment convenience, CurrencyFair doesn’t accept debit or credit card, and it takes funds from bank account only. So, those who hold crypto currencies, money market securities, etc., could not transfer money through CurrencyFair. Currently, CurrencyFair accepts debit cards which are issued by the banks in the Republic of Ireland and in the name of an Irish resident.

For user experience, we rate CurrencyFair 8 out of 10. We would have given higher score to CurrencyFair if customers have a clear knowledge of their transaction with it and review process.

Security : Is CurrencyFair Safe?

The Central Bank of Ireland is regulating the company for its business in Ireland. The Australian Securities and Investments Commission (ASIC) regulates the business of CurrencyFair in Australia. It uses 256-bit encryption via SSL from VeriSign for providing a secure connection.

It held all the customers’ accounts separately and increased security by Two-Factor Authentication. It will combine the password of your account with any of the things whose possession is only with you, for example, mobile phone. It will send a code on the mobile number whenever you try to login or send money.

It also provides 6-digit CurrencyFair PIN which customers need to enter when they want to login or to start any transaction. We believe this security is equivalent to many banks and it deserves 10 out of 10 in this category.

Transfer Type And Modes

Pay In Options

| Bank |

Pay Out Options

| Bank |

Service Mode

|

Online

|

Exchange Rate Type

| Fixed |

CurrencyFair FAQ's

CurrencyFair Vs TransferWise: Which is better?

CurrencyFair and TransferWise both offer competitive exchange rates to the users which is significantly better than big banks. TransferWise offers real mid-market exchange rates while CurrencyFair offers 'peer-to-peer' exchange rates and many times help customers to beat existing exchange rates.

On the basis of ease of use, you can transfer money from a bank account, debit and credit card from TransferWise while CurrencyFair only accepts bank account transfers. You can use a debit card in CurrencyFair which are issued by the Irish government. On the basis of security, CurrencyFair and TransferWise both are secured by SSL security certificates to encrypt your login credentials and all other communications.

Can I transfer funds using debit and credit card on CurrencyFair?

The company does not accept any type of credit card. You can transfer funds using debit card, but that must have been issued by the banks in the Republic of Ireland and in the name of an Irish resident. So, there is only one payout option available with CurrencyFair and that is bank account.

How can I get a CurrencyFair account?

Signing up for a CurrencyFair account is free and straightforward, and anyone can have one in a matter of minutes. All you have to do is visit their website and choose to sign up with your Facebook account or fill up new login details. If you sign up through Facebook, you get direct access, and you can start using the service much faster. If you fill up new information, on the other hand, you will need to confirm your email first before you can proceed.

How does CurrencyFair Works?

If you make transfer through CurrencyFair, then your amount will first transfer to a local company account, where it will try to find you a best match available in the opposite currency. When it will find the match, your amount will be transferred to the recipient’s account. It offer two types of exchange, these are, “Quick Trade” and “Market Place”.

In quick trade, you transfer the funds at the available price and the amount will available to the recipient in next 1-2 working days, while in market place transfer, it takes longer time as you can select the rate you want to transfer the funds. And when the match is available in opposite currency, your amount will be transferred.

It charges a small amount of flat fee on the transfers, i.e., about €3 from your Currencyfair account to a bank account. But if you have multiple currencies in your CurrencyFair account, you can select the currency which is offering the best deal.

In CurrencyFair how long do transfers take?

It may take 1-2 days if you are transferring funds to developing countries for CurrencyFair. However, if you are transferring funds to any underdeveloped country, it might take approximately 5-7 working days.

What if I enter the wrong details when sending money?

Typos can happen to anyone, even the most careful people, especially when in a hurry. If you have entered the wrong details and you have initiated the transaction, you can quickly contact the customer care support by emailing them through support@currencyfair.com or directly by calling them on +353 1 526 8411.

How long does it take to send money with CurrencyFair?

Sending money with currency fair may take about three days for the transaction to complete. That is because processing sent money takes approximately one to two days while money received can take up to a day before it can be available in your CurrencyFair account. It is, however, good to know that services are much faster during the morning hours when banks are more active as much banks only have up to midday to process CurrencyFair transactions for pick-up and transfer.

Is it safe to send money with CurrencyFair?

CurrencyFair is a legally registered limited company in Australia, and it is regulated by the central bank of Ireland and ASIC. That means it has been approved to be legitimate and 100% reliable for users. However, you will need to play your part to ensure the security of your account by ensuring that you don’t share your details with the wrong people.

Alternatives to CurrencyFair

CurrencyFair User Reviews and Ratings

Simple, cheap and easy.

Simple, easy to use and much cheaper than a high street bank.

Reliable and Fast Money Transfer

Transactions are transferred very quickly. Fee charged is a low rate

Simple, quick and good value and customer service.

The process of exchanging money is easy and quick. The very occasional problems have been explained and sorted out on the phone by a very efficient and friendly agent. I have been using Currency Fair regularly since 2011.

I had a little problem with the money I…

I had a little problem with the money I sent for exchange, but on contacting CurrencyFair they helped me solve it and dealt with it immediately. I would highly recommend this company.

Compare CurrencyFair With Other Money Transfer Companies

CurrencyFair Company & Contact Info

| Address:- | Colm House, 91 Pembroke Rd, Ballsbridge, Co. Dublin, Ireland |

| Email:- | [email protected] |

| Phone:- | +353 1 526 8411 |

| Social Links:- |

|

| Apps |

|